Bank AL Habib promotes environmental sustainability through its Green Banking initiatives, while also nurturing a strong culture of social responsibility. By aligning with global sustainability frameworks, engaging employees, and taking steps to reduce its carbon footprint, Bank AL Habib demonstrates its commitment to building a more sustainable future.

Bank AL Habib integrates environmental sustainability across 3 core pillars:

Strengthening Sustainability Through Environmental and Social Risk Management (ESRM) Integration

Environmental and Social Risk Management

Green Business Facilitation

Reduction of the Bank’s Own Environmental Impact

The Bank has embedded an ESRM framework within its credit evaluation process for both new and existing clients. As one of only two banks selected by the State Bank of Pakistan to pilot ESRM in lending, Bank AL Habib commenced full integration of the framework in March 2024. This ensures that all credit proposals are subject to rigorous screening for environmental and social risks. Where risks are identified, an Environmental and Social Action Plan is implemented to ensure continuous improvement and monitoring. To support this initiative, over 1500+ employees have been trained in ESRM, reinforcing compliance with mitigation protocols.

To further strengthen its sustainability strategy, Bank AL Habib has partnered with KPMG Taseer Hadi & Co. Pakistan for consultancy in the implementation, validation and reporting of its Environmental, Social, and Governance initiatives. This collaboration enhances the credibility, effectiveness, and transparency of the Bank s ESG efforts.

WWF-Pakistan Green Office Certification: A Milestone in Sustainable Operations

Bank AL Habib's DHA Phase 6, Lahore branch has been recognized as the first certified Green Office of 2024 by WWF-Pakistan. This certification, part of WWF’s Green Office initiative, aims to reduce CO₂ emissions through energy efficiency, effective waste management, and the adoption of sustainable operational practices.

As part of the certification process, WWF-Pakistan conducted a comprehensive audit, validating Bank AL Habib's commitment to environmental sustainability. This achievement highlights the Bank's continued efforts to enhance resource efficiency through water and energy conservation, minimized paper consumption, and responsible procurement practices.

Empowering Employees for a Sustainable Future

Employee engagement plays a vital role in Bank AL Habib's sustainability journey. To build internal capacity and foster a culture of environmental responsibility, 3,500+ employees across the country have participated in more than 75+ sessions focusing on key topics such as Green Banking, Green Taxonomy, and Environmental and Social Risk Management. These initiatives promote a deeper understanding of sustainable finance and risk mitigation.

To further embed sustainability in its corporate culture, Bank AL Habib has introduced a Green Culture initiative, which includes regular sustainability bulletins to raise staff awareness. Additionally, sustainability principles have been integrated into the Management Trainee Officer program, equipping future leaders with the knowledge and tools to champion environmental stewardship in the financial sector.

Driving Resource Efficiency Through Green Branches

Bank AL Habib is actively expanding its network of green branches, with seven locations already designated as sustainable branches. These branches operate with a focus on 5 key sustainability indicators:

Paper

Fuel

Water

Electricity

Waste

To promote responsible consumption, the Bank closely monitors paper usage across its operations, achieving significant reductions. To minimize electricity consumption and reliance on non-renewable energy sources, these branches are powered by solar energy. The Bank has also partnered with a specialized vendor to manage recycling and waste repurposing, significantly reducing landfill contributions.

To further reduce its carbon footprint, Bank AL Habib encourages virtual meetings to limit travel and associated fuel usage. In support of transparency and performance tracking, the Bank is developing an online database for real-time reporting on resource consumption and reduction milestones. Additionally, the Bank's Green Procurement Strategy ensures that all purchasing decisions are aligned with environmentally sustainable standards, reinforcing its long-term commitment to responsible operations.

Alignment with the United Nations’ Sustainable Development Goals.

Bank AL Habib’s sustainability efforts are closely aligned with the United Nations' Sustainable Development Goals (SDGs), reflecting the Bank’s commitment to driving positive environmental and social impact. Through its initiatives, Bank AL Habib contributes to the global agenda for sustainable development, aiming to build a more resilient and inclusive future by 2030.

Good Health and Well Being

Since 2024, Bank AL Habib has placed an even stronger emphasis on employee well-being by conducting a series of health and wellness initiatives. These include workshops on stress management, awareness sessions on Thalassemia, breast cancer, and diabetes, as well as emotional intelligence training to foster a healthier and more supportive work environment.

Health, Safety, and Environment remains a key operational priority for the Bank. Regular fire drills are conducted across all premises, complemented by comprehensive training sessions designed to equip employees with essential safety knowledge and emergency response protocols. This proactive approach not only enhances workplace readiness but also encourages the adoption of safety practices beyond the office, promoting a culture of well-being and responsibility.

Gender Equality

Bank AL Habib is committed to advancing gender equality through inclusive hiring practices and other women-centric initiatives. The "Banking on Equality" department, which oversees the AL Habib Woman, a dedicated portfolio of banking services for women, is a prominent feature of the Bank. This department also manages various women-focused initiatives within the Bank.

Aligned with its vision of empowering women in business, the Bank has introduced the AL Habib Kamyab Khatoon Zarai Finance scheme, offering specialized financial products for female agri-entrepreneurs across Pakistan. Additionally, the Bank AL Habib Woman ApniCar Auto Finance Facility allows women to fulfill their dream of car ownership with flexible repayment plans and affordable rates. The Bank celebrates International Women’s Day and Women’s Week to further promote financial inclusion and highlight the critical role of women in the economy.

Affordable and Clean Energy

In 2024, Bank AL Habib successfully solarized 57 branches, with a total installed capacity exceeding 682KW, reflecting a 52% increase from the previous year. The Bank is committed to further expanding its solarization efforts in 2025, continuing to enhance its sustainability initiatives and reduce reliance on non-renewable energy sources.

Health, Safety, and Environment remains a key operational priority for the Bank. Regular fire drills are conducted across all premises, complemented by comprehensive training sessions designed to equip employees with essential safety knowledge and emergency response protocols. This proactive approach not only enhances workplace readiness but also encourages the adoption of safety practices beyond the office, promoting a culture of well-being and responsibility.

Decent Work and Economic Growth

Bank AL Habib supports inclusive economic growth through targeted recruitment programs focused on youth, women, and marginalized communities. The Bank offers competitive employee benefits and leadership development opportunities, while also advancing financial inclusion through its expanding digital banking services.

By providing customized financial solutions for small and medium enterprises and women entrepreneurs, Bank AL Habib plays a key role in promoting job creation and driving economic diversification across the country.

Reduced Inequalities

Bank AL Habib is dedicated to fostering financial inclusion and accessibility by employing over 150 persons with disabilities (PWDs) and retrofitting more than 14 branches to ensure ease of access for all. These enhancements include wheelchair-friendly entrances, ATM cabins, and cash counters, along with ramps, railings, and tactile flooring to support mobility.

To further accommodate customers and employees with disabilities, the Bank has introduced dedicated service counters, token systems, help desks, and designated parking spaces. Branches are equipped with wheelchair-accessible door designs, appropriate signage, and Braille materials to enhance the banking experience.

Recognizing the importance of inclusive communication, Bank AL Habib has trained staff in effective interaction with PWDs and introduced Sign Language training and sensitization sessions through its Training & Management Development Division. Additionally, the Bank launched an e-learning module, AL Habib iLearn, to promote continued awareness and understanding of PWD-related sensitivities.

With nearly 98% of its branches now accessible, Bank AL Habib reaffirms its commitment to reducing inequalities and building a truly inclusive environment for both customers and employees.

Climate Action

Bank AL Habib offers Smart Climate Agriculture Financing to promote resource-efficient practices and technologies across both agricultural and non-agricultural sectors. This tailored financing solution supports the adoption of alternative energy systems, advanced water management techniques, and precision agriculture practices, enhancing sustainability and operational efficiency across the agricultural value chain.

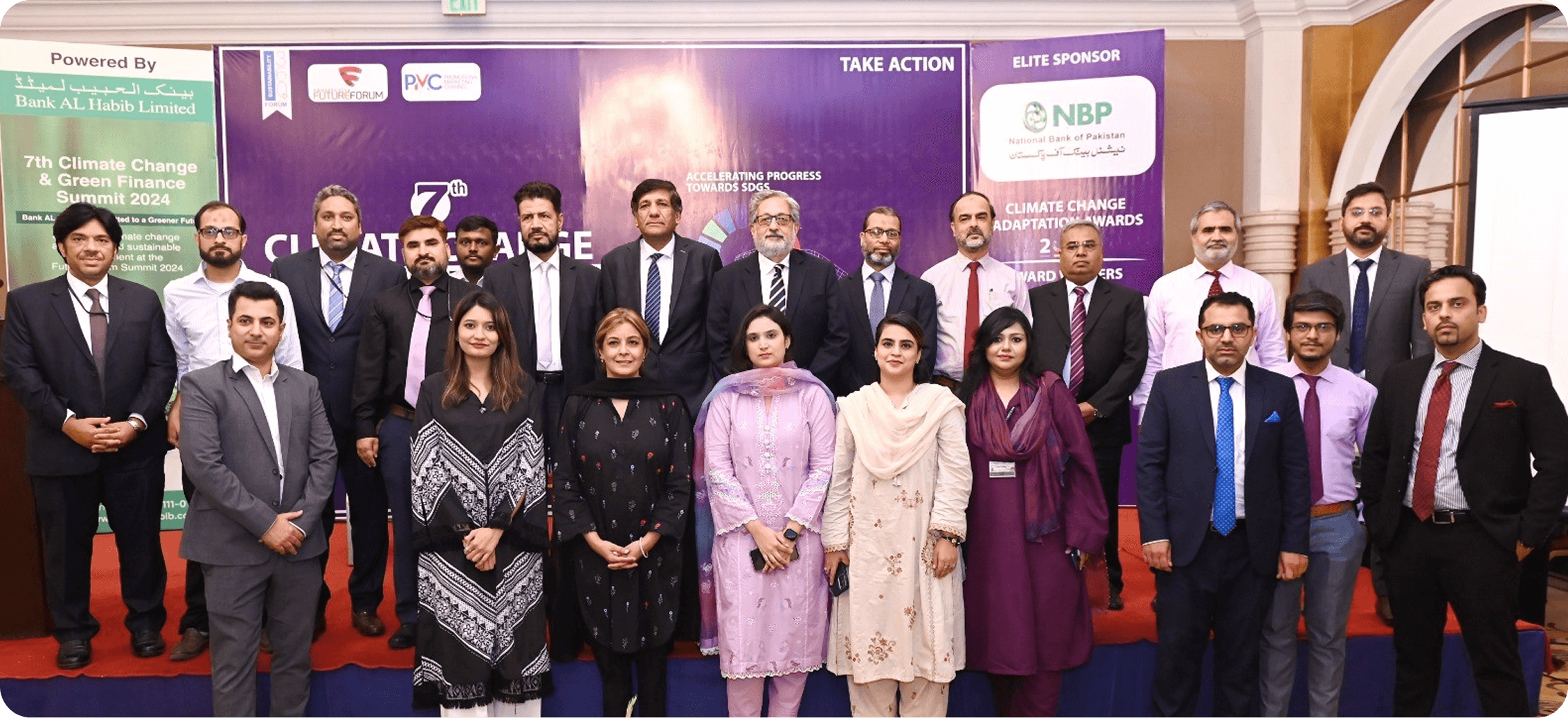

Beyond financing, the Bank actively contributes to environmental awareness and policy dialogue. It has published insightful articles on critical topics such as green taxonomy, sustainable supply chains, and carbon markets in leading English, Urdu, and Sindhi newspapers. Additionally, Bank AL Habib collaborates with prominent think tanks such as Future Forum and regularly participates in national and international summits dedicated to green finance and climate change—reinforcing its commitment to driving impactful, knowledge-based sustainability initiatives.