Apni Car Finance

Leading to your dreams

Bank AL Habib ApniCar Auto Finance facility leads to your dream car through convenient repayment plans.

ApniCar Auto Finance Features and benefits

Free Accidental Insurance up to PKR 500,000

Financing available for brand new and used vehicle (locally manufactured)

Easy monthly installments

Early/Partial payments option (without any charges)

Quick processing and minimal documentation

Also available under Islamic mode of Financing (Diminishing Musharaka)

Option of Fixed and Variable Rates

Auto Loan Pricing

| Product | Tenure | Fixed Rates | Variable Rates | ||

|---|---|---|---|---|---|

| New/Used | New/Used | ||||

| Fast Track | DRP | Fast Track | DRP | ||

| Auto Loan | 1-2 Years | 1YK + 4.0% | 1YK + 4.5% | 1YK + 3.0% | 1YK + 3.5% |

| 3 Years | 1YK + 4.5% | 1YK + 5.0% | 1YK + 3.5% | 1YK + 4.0% | |

| 4-5 Years | 1YK + 5.0% | 1YK + 5.5% | 1YK + 4.0% | 1YK + 4.5% | |

Note:

- In Fast Track variant, additional 0.5% shall be charged where relationship with BAHL is less than 6 month

- For Fixed and Variable Rate Option: The 1 Year KIBOR of last day of previous month will determine the applicable rate

- For Fixed Rate Option: Applicable Rate will remain the same for the entire tenure

- For Variable Rate option: Applicable Rate is subject to change in KIBOR at each anniversary of financing.

Who can apply for Bank-AL-Habib ApniCar Auto Finance

-

Pakistani Nationals

-

Account holder of any Bank

-

Salaried person, Businessman or Self-employed

-

Individuals having other source of income i.e. Remittance, Rental, Pension, or Investments may also apply if they maintain satisfactory account at Bank AL Habib

Visit your nearest branch

-

Our highly trained executives will take care of your financing requirements

-

The only thing you need to worry about is choosing the car and its colour

Documents Required

- Salaried Individual

- Two recent photographs

- Copy of Computerized / Smart National Identity Card (CNIC / SNIC)

- Proof of Permanent/Regular employee and 1 Year working experience

- Proof of 2 Years working experience for Contractual Employees

- Bank Statement of Last 6 months with reflection of salary credits

- Last 3 months salary slip/salary certificate

- Self - Employed Individual

- Two recent photographs

- Copy of Computerized / Smart National Identity Card (CNIC / SNIC)

- Acceptable Proof of Business of last 2 years

- Bank statement of last 6 months

Frequently Asked Questions

- Can I avail the ApniCar Auto Finance facility?

Yes if you are:

- Pakistani National Citizen holding valid CNIC / SNIC

- Having satisfactory credit history

- What type of cars does Bank AL Habib finance?

Following Categories are being offered in Bank AL Habib Car Financing:

- Locally Manufactured Brand New Vehicles for personal use.

- Locally Manufactured Used cars above 1000cc; not older than 7 years from the date of manufacturing.

- Locally Manufactured Used cars up to 1000cc; not older than 5 years from the date of manufacturing.

- What is the maximum loan amount?

Upto PKR 3,000,000/- aggregate in all banks/DFIs.

- What is the tenor of this facility?

- Financing for 5 Years only for Vehicles upto 1000cc

- Financing for 3 Years only for Vehicles above 1000cc

- What is the minimum down payment?

- Minimum 30% for locally manufactured brand new vehicle

- Minimum 35% for locally manufactured used vehicle

Minimum Down Payment varies in accordance with the variant and the model of vehicle

- What would be my total up-front payment?

You have to pay Down payment, processing fees & first year insurance premium

- Who will insure the vehicle?

We have arrangements with various renowned insurance companies which offer special rates for Bank AL Habib customers.

- How do I repay the Financing ?

You need to repay through Direct Debit Authority.

- Can I repay the car loan before the maturity?

Yes, you have the option to repay the loan at any point in time during the tenure of the loan

- Is there an option to make partial payments?

Yes. Partial payments can be made twice a year without any fee(after every six months) with a minimum of PKR 50,000/-.

- Who will evaluate the price of locally manufactured used vehicle?

The Bank arranges the valuation through its panel of approved surveyors/valuators.

- What is the security of the loan?

The vehicle is the security, which will be hypothecated in favor of Bank AL Habib through Motor Registration Authority.

- What is the first step to proceed for application?

- Visit the nearest Bank AL Habib Branch

- Call our 24X7 Helpline

- Email at apnicar@bankalhabib.com

Housing Finance

Bank AL Habib makes it easy to own a dream home

We believe, home is a place where the heart and mind are at peace. Bank AL Habib keeping its long and recognized history for customer oriented products and services, offering "AL Habib Housing Finance" which facilitates the customers under following segments:

Product Features

- Low and competitive mark-up rates

- Tenure of Financing: 1-25 years

- Co-Applicant option available (Spouse, Father, Mother and Son)

- No charges for early settlement and balloon payment(s)

- Repayment in equal monthly installment

- Free life insurance/takaful coverage (T&Cs apply)

Eligibility Criteria

-

Must be Pakistani National.

-

Minimum 1 year relation with any bank(s).

-

Debt Burden Ratio (DBR): Up to DBR 50% aggregate of Net Income.

-

Age: Minimum 25 Years. Maximum 60 years for Salaried; & 65 years for Self Employed Professional (SEP) and Self-Employed Businessmen (SEB) at maturity of financing.

-

Employment/Business Tenure: Minimum 2 years for Salaried and SEP. Minimum 3 Years for SEB.

-

Minimum Income: Rs.60,000/- per month take home for Salaried and Rs.100,000/- per month for SEP / SEB

-

Satisfactory credit history

-

Co-borrower with minimum net take home income Rs.30,000 may be added for income clubbing and property ownership purposes.

Property Insurance/ Takaful

Property Insurance Coverage at customer cost

Applicable Financing Rate

For Salaried individuals

1 Year KIBOR + 3% p.a

Other then Salaried

1 Year KIBOR + 3.5% p.a

Rate revision on each category will be on loan anniversary.

Documents Required

- For Salaried Individuals

- Bank's prescribed Application Form

- Valid Computerized National Identity Card

- 3 recent photographs (passport size)

- Employment proof of last 2 years

- Salary Slips of last 3 months

- 1 year Bank Statement with reflection of salary credits

- For Self Employed Businessmen (SEB) & Self Employed Professional (SEP)

- Bank's prescribed Application Form

- Valid Computerized / National Identity Card

- 3 recent photographs (passport size)

- Acceptable proof of business of last 3 years for SEB and 2 years for SEP

- Last 1 year Bank Statement and Account Maintaining Certificate

Frequently Asked Questions

- How to apply for Bank AL Habib Housing Finance?

Fill the application form and visit your nearest branch of Bank AL Habib.

- What is the mark-up rate?

Variable Rate i.e. 1 Year KIBOR (subject to review on each anniversary of loan) plus bank’s spread (fixed during the entire tenure of the loan)

- What is the tenor?

For Home Buyer, Home Construction, Plot Purchase + Construction, Home Improvement and Balance Transfer Facility 1 to 25 years. - What is the minimum & maximum financing amount?

Home Buyer PKR 0.3M to 100M Plot Purchase + Construction PKR 0.3M to 100M Balance Transfer / Home Construction PKR 0.3M to 50M Home Improvement – Residential House PKR 0.3M to 20M Home Improvement – Residential Apartment PKR 0.3 to PKR 5 M - Who is eligible to apply?

- All Pakistani nationals.

- Employment/Business Tenure: Minimum 2 years for Salaried and SEP, 3 Years for SEB.

- Minimum Income: Rs.60,000/- per month take home for Salaried and Rs.100,000/- per month for SEP / SEB.

- Debt Burden Ratio (DBR): Up to DBR 50% aggregate of Net Income.

- Who will assess the value of property?

Bank AL Habib has exclusive arrangements with PBA approved valuators.

- What are the different disbursement stages for payments in the home construction loan?

The stages are as follows:

Plinth and Foundation Stage 30% Structure completion 30% Finishing Stage 40% - I am a Businessman/Self Employed Professional, how will you assess my income?

From last 1 year bank statement or income estimation whichever is applicable.

- What is the process of income estimation?

A representative from our approved income estimation agency will visit your place of business/work and appraise your income level, by going through the documents provided by you.

- What is the repayment method?

An account will be opened at the respective branch which is closest and the most convenient to you. A direct debit instruction in favor of Bank AL Habib would allow the bank to debit the installment amount from your account on a monthly basis.

- What if I already have an account with Bank AL Habib?

If you already have an account with Bank AL Habib, you can give direct debit standing instructions in favor of Bank AL Habib which would allow us to debit the installment amount from your account on monthly basis.

- Whom should we contact?

Consumer Banking Division

UAN: 111-111-176

The details of Relationship Managers are following:

Mr. Muhammad Samiuddin: 021-32463059, Ext: 100

Mr. Kamran Haider: 021-32463059 Ext: 204

Mr. Agha Farrukh: 021-32463059, Ext: 229

Syed Aliya Zaidi: 021-32460125, Ext: 229 - Other information you should know

We have provided you the basic information you need to know about Bank AL Habib Home Loan. If you wish to know more, you may visit any of our Bank AL Habib branch. Our designated Retail Credit /Account Officers/Credit Officer in respective branches are available for your guidance.

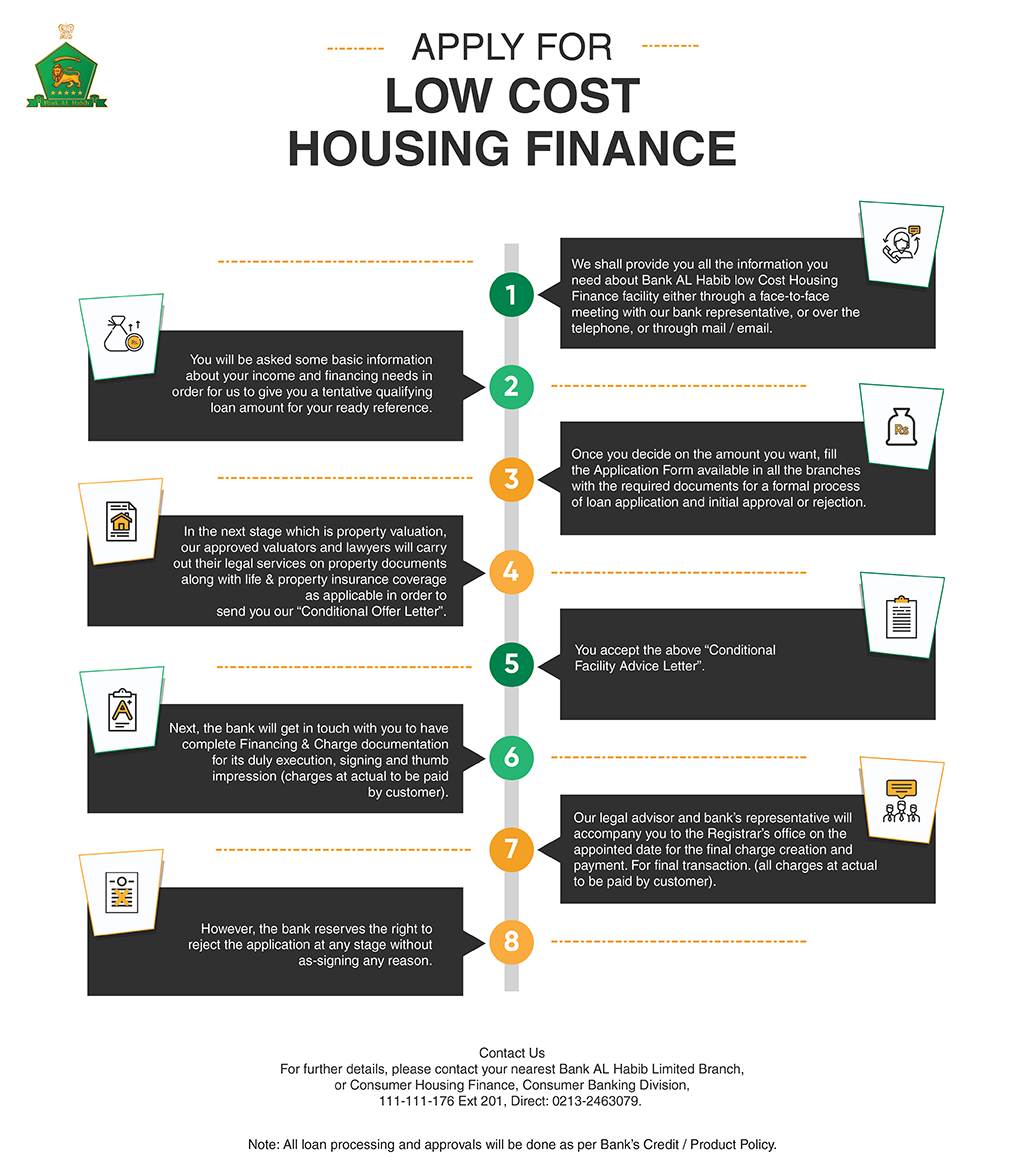

- Visit and meet respective representative at Bank AL Habib branch

- If you meet the criteria, you need to fill up the application form and submit it along with required documents

Once you have finalized the financing amount, fill the Application Form available in all branches and submit it along with the required documents for a formal process of the loan application and initial approval.

Property valuation and legal opinion on property documents is carried out through our approved valuators and legal counsel.

Free life Insurance/Takaful coverage upto the financing amount and Property Insurance / Takaful is mandatory. Further, property insurance premium is to be paid by the customer.

For case assistance, our designated Relationship Managers are available for all sorts of guidelines and processes for Pre and Post Disbursements.

Our legal advisor and bank’s representative will accompany you at the Registrar’s office on the appointed date with banker’s cheque for final transaction.

All applications for Housing Finance will be processed as per bank's approved Product program, policies, internal procedures, applicable laws and regulations.

Renewable Energy Solutions

Bank AL Habib Limited persistently works towards providing convenience and value added services to its customers and is pleased to offer a Financing Scheme for Renewable Energy Solution under Category-II for personal residential use only.

Category:

To cater the energy needs of an individual customer, looking to install solar energy solutions to generate electricity up to 1 MW.

Renewable Energy Solutions Features

-

Maximum Financing limit up to Rs 2,500,000/-.

-

Customer Equity Participation minimum 15%.

-

Repayment in equal monthly installments (during 3 a months’ grace period only mark-up will be recovered).

-

Full payment - Allowable without any charges.

-

Partial payment - Allowable without any charge.

-

Unit/Project payment will be made to manufacturers / suppliers / contractors only by bank.

-

Mandatory Insurance of the unit installed.

-

The loan shall be available for installation of only brand new project under this category.

Who can apply for Bank-AL-Habib Renewable Energy Solutions

-

Pakistani Nationals.

-

Minimum age should be 25 years. Maximum age at the time of loan maturity should not exceed 60 years for salaried employees and 65 years for Businessmen / Self Employed Professionals (SEP).

-

Salaried individuals must be a permanent employee for at least 2 year of employment track record.

-

3 Years minimum business tenure for Businessmen.

-

2 Years minimum business tenure for SEP.

-

Minimum net take home salary should be at least Rs.60,000/- and for Businessmen / SEP Rs.100,000/- per month.

-

Property where the unit/project will be installed should be in the name of borrower either primary or co-borrower. However, spouse can be made as co-borrower(s).

-

Consolidated borrowing of a single borrower under this category shall not exceed Rs.400 million from any Bank/DFI.

-

Loan will be approved based on the income of the applicant subject to meeting the Debt Burden Requirement (DBR) or maximum 85% of the invoice / quotation value (whichever is lower).

Documents Required

- Salaried Individual

- Bank's prescribed Loan Application Form.

- Valid Computerized National Identity Card.

- 3 recent photographs (passport size).

- Undertaking of Existing Liabilities.

- (CF-1) duly filled by the applicant.

- Letter of Understanding.

- Employment Letter with current designation, salary & joining date.

- Last 3 months Salary Slips.

- Last 1 year Bank Statements.

- Information of Two references and copies of their CNIC.

- Any other valid proof of income acceptable to the bank.

- Two quotations of the Unit/Project of similar specifications from different vendors will be required prior to approval.

- Feasibility report/finalized proposal from client selected vendor for the proposed renewable energy system.

- Certification from Alternative Energy Development Board and Pakistan Engineering Council is only required if the borrower is opting for net metering

All charges pertaining to processing fee, legal, property & valuation charges and any other charges will be as per bank’s applicable schedule of charges.

- Self - Employed Individual

- Bank`s prescribed Loan Application Form.

- Valid Computerized National Identity Card.

- 3 recent photographs (passport size).

- Undertaking of Existing Liabilities.

- (CF-1) duly filled by the applicant.

- Letter of understanding.

- Acceptable Business Proof (e.g. Tax Returns, NTN Certificate / Bank Certificate).

- Last 1 Year Bank Statement.

- Information of Two references and copies of their CNIC.

- Two quotations of the Unit/Project of similar specifications from different vendors will be required prior to approval.

- Feasibility report/Finalized proposal from client selected vendor for the proposed renewable energy system.

- Certification from Alternative Energy Development Board and Pakistan Engineering Council is only required if the borrower is opting for net metering.

All charges pertaining to processing fee, legal, property & valuation charges and any other charges will be as per bank’s applicable schedule of charges.

Low Cost Housing Facility for Special Segment

Bank AL Habib has now also started to cater Financing Facility for Low Cost Housing for Special Segments. The purpose of the loan is to make low cost housing affordable to lower middle and low income segment for only Construction (Including Plot Purchase) of new housing unit.

Special Segment:

-

Widows.

-

Children of Martyrs (Shaheed) of law & enforcement agencies, armed forces and Civilians martyred in terrorist attacks.

-

Special persons holding CNIC / SNIC with disability logo/ symbol.

-

Transgender.

-

Persons who desire to construct (including plot purchase) housing units in the Mohmand, Bajaur, Orakzai, Kurram, Khyber, North Waziristan and South Wazirstan districts of Khyber Pakhtunkhwa.

Eligibility Criteria:

All customers must fulfill the following requirements to be eligible for Bank AL Habib low cost housing finance for special segments:

-

Must be a Pakistani national.

-

Valid CNIC / SNIC / NICOP

-

Borrower’s Age:

Minimum 18 years

Maximum 60 years for Salaried*

65 years for Self Employed Professional/ Business Persons*

70 years for Widows*

*at loan maturity -

Individuals in the above categories can avail financing subject to following eligibility criteria / conditions:

-

The borrower must not own any residential housing unit /flat / apartment. The borrower must not have availed housing finance previously from any bank/DFI. The loan shall be available only for construction (including plot purchase) of new housing unit. Maximum value of the housing unit, being financed under this scheme, shall be PKR 3 million (including plot value).

-

Existing individual customers maintaining satisfactory relationship. Minimum 6 months of active relationship with Bank AL Habib.

-

Bank AL Habib Corporate/Commercial Relationships.

-

Minimum Income PKR, 30,000/- with 1 year Employment/business proof.

-

Installment not to exceed 40% of the monthly take home income.

-

The aggregate Debt Burden should not be more than 50%

-

Sale or renting out of housing unit, financed under this scheme, shall not be allowed until full adjustment of outstanding finance or five (5) years after the date of first disbursement or, whichever is earlier.

Financing for Home Construction

- This facility will be extended to individuals who never had a house owned in his/her or spouse name for plot purchase + construction thereon.

- Only Spouse can be made as Co-borrower for income clubbing or property ownership. Income of spouse can be clubbed with primary borrower after obtaining his/her written consent for income clubbing and making him/her co-borrower in the case. However other credit parameters of the co-borrower will be as of the basic borrower.

- Maximum Financing amount PKR 2.7 Million for plot purchase + construction thereon.

- The financing for plot, to be purchased for the purpose of constructing house shall be allowed up to 1 million only.

- Financing under any of the above conditions will be based upon net income of the applicant to ascertain repayment capacity.

- Financing shall be available for a maximum period of 12½ years, which includes maximum grace period of 6 months.

- Disbursement will be made in tranche percentage wise according to construction phase.

- Plinth & Foundation 30%

- Structure 30%

- Finishing 40%

- Land/Property valuation(s) will be made from an approved PBA valuator on Bank’s panel.

- Legal requirements to be completed by applicant as deemed necessary by the Bank’s Legal Counsel.

- Repayment in equal monthly installments based on the tenure of financing (including 6 months grace period for construction, where only mark up is to be serviced).

- Customer will have the option of making balloon payments. With no charges

Pricing

-

Fixed at 5%.

Security:

- Equitable/Token mortgage with lien marking at the respective authority

- Life Insurance & Property Insurance Coverage

Charges:

As Per Bank's Schedule of ChargesDistribution:

Nearest Branch of Bank AL Habib

Documents Required

- Document Check List

- Financing Application Form completely filled and signed.

- 3 recent passport size photographs of primary & co-applicant.

- Valid CNIC / SNIC of primary/co-applicant (Old NIC will not be acceptable).

- Declaration of other loan liability (CF-1).

- Latest 3 months salary slips (if any)

- Latest Salary/employment certificate (if any)

- Last one year bank statement; where salary is being credited (if any)

- 1 Year Business Proof (if self Employed / Self Business)

- Verifiable income proof.

- Any other document deemed necessary

Frequently Asked Questions

- Who is eligible for Bank AL Habib Low Cost Housing for Special Segments?

- Widows

- Children of martyrs (Shaheed)

- Special persons (Disable logo appearing on CNIC / SNIC)

- Transgender

- Persons who desire to construct (including plot purchase) housing units in the Mohmand, Bajaur, Orakzai, Kurram, Khyber, North Waziristan and South Waziristan districts of Khyber Pakhtunkhwa.

- What is the mark-up rate?

Fixed at 5.0%.

- What is the tenor?

12½ years for all Special Segments.

- Who will assess the value of property?

Bank AL Habib has exclusive arrangements with PBA approved valuators for this purpose.

All expense incurred on property valuation / BBQ assessment will be made borne by the

customer. - What are the different disbursement stages for payments in the home construction loan?

The stages are as follows:

Plinth Stage 30%

Structure completion 30%

Finishing Stage 40% - How will you assess my income?

We will assess your income by acquiring all such documents that are verifiable and prove your income.

- What is the process of income estimation?

If necessary a representative from our approved evaluation firm will visit your place of business/work by taking a prior appointment with you and appraise your income level, by going through the documents and data provided by you.

- What will be the Repayment method for the loan?

An account will be opened for you at the Bank AL Habib branch nearest to your location. You will need to maintain funds in this account sufficient to cover your monthly installment. With your written authorization, Bank AL Habib will automatically deduct the installment amount each month, ensuring a smooth and timely payment process.

- What if I already have an account with Bank AL Habib?

If you already have an account with Bank AL Habib, you can give direct debit standing instructions in favor of Bank AL Habib which would allow us to debit the installment amount from your account on monthly basis.

- What is the penalty on early settlement of the loan?

There is no penalty on early settlement

- To whom payment will be made?

If the case is to purchase plot plus construction then maximum Rs.1 million can used for plot purchase and payment will be made to the original seller. The remaining Rs.1.7 million will be paid to applicant in stages as defined above

Cash Finance

Need cash without encashing your savings?

Bank AL Habib Cash Finance is a hassle-free secured personal loan that provides cash for your need at the most competitive rate against your National Savings Certificates, Pak Rupee/Foreign Currency Bank AL Habib Deposits & First Habib Cash Fund units

Bank AL Habib Cash Finance works in two ways

-

Running Finance Facility (RF), a Revolving line of Credit with quarterly mark-up servicing

-

Term Finance Facility (TF), 1 Year to 4 Years, repayments in equal monthly installments.

What makes AL Habib Cash Finance a great option?

Prompt & Hassle-Free Processing

Balance Transfer Facility

Documentation Charges at Actual

No Pre-payment Penalty

Third Party security of Bank AL Habib Deposit/National Saving Certificates

PayPak Debit Card (Default)*

Free Online Banking

Free eStatement/ AL Habib Mobile and Netbanking Facility

*Customers can avail free PayPak Debit Card on the condition of maintaining a minimum monthly average balance of PKR 25,000/- However, you can also opt for a Visa or UnionPay Card. Charges will be applicable as per prevailing Schedule of Bank Charges.

Who can avail AL Habib Cash Finance facility?

-

Resident Pakistanis such as Salaried, Self Employed & Business Individuals.

-

Having Requirement of funds for personal use.

-

Having Satisfactory Credit History.

Finance Amount

-

Minimum Finance amount is PKR 50,000/-.

-

Maximum 90% against PKR Deposits (only profit bearing accounts), FCY Savor Deposit / Encashment value of Securities and 85% on Foreign Currency Deposits.

Securities and Pricing

Financing upto PKR 5.0 Million Against Bank AL Habib PKR Deposits (only profit bearing accounts)

Running Finance

2.00% over Deposit Rate

Term Finance

1.50% over Deposit Rate

Financing upto PKR 5.0 Million (Against Foreign Currency Deposits and Permissible Government Securities)

Running Finance

2.00% over 3 Months KIBOR

Term Finance

1.50% over 1 Year KIBOR

For Financing of over PKR 5.0 Million

Running Finance

1.50% over 3 Months KIBOR

Term Finance

1.25% over 1 Year KIBOR

Note:

DSC, SSC & RIC of minimum 3 months age or above would be acceptable

Documents Required

- Documents Required

- Bank's prescribed Application Form

- Copy of CNIC / SNIC

- Latest salary slip / Salary Certificate (For salaried person)

- Bank Account Statement for last six Months (For Business Person) Any other document of income proof, if available

- Liability declaration (CF-1)

Open a Cash Finance Account

- Visit nearest Bank AL Habib Branch for an Account Opening Form

- Submit the duly completed form with all supporting documents

Frequently Asked Questions

- What kind of financing facility does the Bank provide under AL Habib Cash Finance?

We offer both Term Finance (TF) & Running Finance (RF) Facility for individuals to meet their personal, family or household needs.

- What is the amount of financing offered under AL Habib Cash Finance?

Minimum Finance amount is PKR 50,000/- Maximum 90% against PKR Deposits (only profit bearing accounts), FCY Savor Deposit / Encashment value of Securities and 85% on Foreign Currency Deposits.

- What is the mark-up rate?

For Financing up to Rs. 5 Million For Financing Above Rs. 5 Million Running Finance Term Finance Running Finance Term Finance Against Bank AL Habib PKR Deposit 2.0% over Deposit Rate 1.5% over Deposit Rate 1.5% over Deposit Rate 1.25% over Deposit Rate Against Bank AL Habib Foreign Currency Deposit, and Permissible Government Securities 2.0% over 3 Month KIBOR 1.5% over 1 Year KIBOR 1.5% over 3 Month KIBOR 1.25% over 1 Year KIBOR Against Bank AL Habib Foreign Currency Savor Deposit 3 Month KIBOR 6 Month KIBOR 3 Month KIBOR 6 Month KIBOR Against First Habib Cash Fund 2.0% over 3 Month KIBOR 1.5% over 3 Month KIBOR 1.5% over 3 Month KIBOR 1.25% over 3 Month KIBOR - What is the frequency of mark-up repayment?

Quarterly mark-up in Running Finance is payable within 15 days of it’s becoming due. Monthly mark-up payable will be included in Equal Monthly Installment for Term Finance. Late Payment charge of PKR 500 shall be applicable after due date

- What is the Security required to avail from AL Habib Cash Finance?

Bank AL Habib Deposit and / or Defence Saving Certificates, Special Savings Certificates, Regular Income Certificate, Market Treasury Bills, Pakistan Investment Bonds, and Premium Prize Bonds shall be acceptable as security.

- Will third party security be acceptable?

Yes, Bank AL Habib Deposit/ Govt Securities both are acceptable.

- Can my Behbood Certificates be considered as security?

No. As per SBP regulations, only DSCs, SSCs, RICs are acceptable.

- What is the processing fee for this facility?

Processing Fee is applied as per the Schedule of Bank charges

Laptop Financing under PMYB&ALS

Flexible, convenient financing that makes owning the latest laptop easier and more affordable.

Product Features

No Markup/Rental will be charged

Financing Available for Brand New Laptops

Early & Partial payment option (without any charges)

Quick processing & Minimal Documentation

Eligibility Criteria

- Primary applicants can only be an immediate family member (parents, spouse, or siblings)

- Students (Pakistani Nationals) aged between 18 and 30 years

- Students of HEC-recognised institutions

- Minimum Employment: 1 year (Primary Applicant)

Financing Amount

- Basic Laptop: Up to PKR 150,000/-*

- Medium Laptop: Up to PKR 300,000/-*

- Advanced Laptop: Up to PKR 450,000/-*

*or actual cost, whichever is lower

Tenure

- Up to 4 Years

Pricing

- 0% Markup

Debt to Equity Ratio

- Bank Share: 80%

- Applicant Share: 20%

Income Requirement (Primary Applicant)

- Minimum Net Monthly Income: PKR 35,000/-

Documents Required

- List of Documents

- Consumer Finance Application Form

- CNIC of Student (Copy)

- CNIC of Primary Applicant/Guarantor (Copy)

- CNIC of 2 References (Copy)

- 2 Passport-sized Photographs of Student

- 2 Passport-sized Photographs of Primary Applicant

- Income Proof of Primary Applicant

- University Card of Student (Copy)

- Bank Statement of Primary Applicant (Last 6 Months)

- Undertaking from University (Holding of Degree)

- ECIB of Student

- ECIB of Primary Applicant