Raast is Pakistan’s first instant payment system that enables end-to-end digital payments among individuals, businesses and government entities within seconds. Not only that it helps bring down the high cost of the transactions making small-value retail payments cheap.

Simplified P2M Payments via RAAST

Bank AL Habib has recently added the Raast Person-to-Merchant (P2M) feature to AL Habib Mobile which allows customers to scan Raast QR codes to make payments.

Customers may also use the "Merchant Alias Payment" option which allows them to make payments through AL Habib Mobile and Netbanking using unique identifiers such as Virtual Payment Address (VPA), Till Code, or Merchant ID assigned to merchants.

P2M will enable customers to pay directly to merchants for shopping, dining, and monthly utility expenses. With just a quick scan of the QR code provided by the merchant, transactions can swiftly and securely be completed, eliminating the need for cash or physical cards.

Key Features

Funds Transfer on Merchant Alias

Customers can make payments by scanning Raast P2M accepted QRs

Only account-based transactions can be performed

Frequently Asked Questions

- What is RAAST?

Raast is Pakistan’s first Instant Payment System which allows you to transfer funds quickly, securely, and easily on Raast ID’s (registered mobile number) or IBAN. It is a payment gateway that allows real-time transfer of money without any charges.

- Why should I use RAAST?

RAAST will connect you with every bank. RAAST offers a simple, fast, secure and convenient way to transfer money from one bank account to another.

- How do I start using RAAST?

Select Raast channel on AL Habib Netbanking or Mobile App and start making payments or fill a debit authority form via any AL Habib Branch to transfer funds via Raast.

- Which partner banks are currently active?

Please see the list of current partner banks

- Are payments made via RAAST safe?

Yes, RAAST offers reliable, state of the art security features to ensure payments are protected and secure.

- How can I register complaints with reference to RAAST transactions?

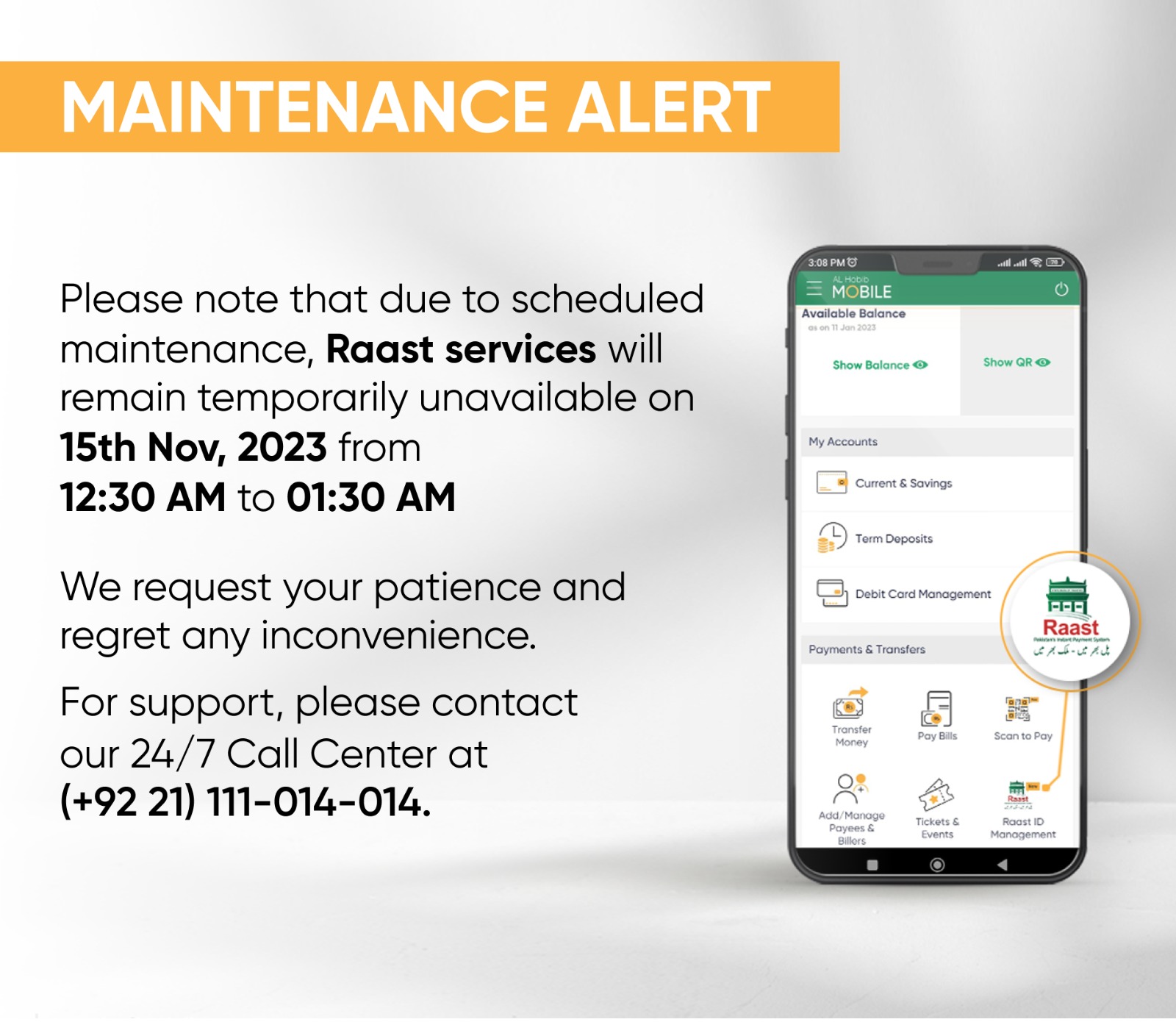

Please contact our 24/7 Call Center at (+92-21) 111-014-014) to raise any concerns, issues and queries.

- Do I need a bank account to use RAAST?

Yes, you need to have an account with a bank or any other payment service provider to connect it with RAAST.

- What is RAAST ID?

RAAST ID is a simple identifier (currently mobile number) that you link with your bank account. Instead of sharing bank account numbers, you can now share your RAAST ID (mobile number) with others and start receiving funds in your linked account.

- Do I need to register a RAAST ID to use RAAST?

Yes, you will need to register your RAAST ID if you wish to receive payments on your RAAST ID (registered mobile number with bank).

However, you do not need to register Raast ID to start sending payments via Raast to other RAAST IDs and IBANs.

- Can I register multiple RAAST IDs and / or multiple accounts against a RAAST ID?

Currently, an individual can only register "ONE" RAAST ID with one linked account (regardless of the number of bank accounts or mobile numbers they may have).

- Can I change my linked bank account against my RAAST ID?

Yes, you can un-link your RAAST ID from your current bank account and can re-link this RAAST ID with another bank account. For further details please contact your respective bank.

- How can I modify / delete my RAAST ID or my consumer details?

Please refer to Raast tutorial. If you are still unable to modify/delete your Raast ID then please reach out to the bank where your Raast ID is registered.

- What are the charges for sending and receiving funds using RAAST?

In spirit to promote financial inclusion in Pakistan, currently there are no charges on RAAST transactions.

- What are the channels to transfer funds via Raast?

RAAST is available for payments via AL Habib Netbanking, AL Habib Mobile App & Over the Counter at all Bank AL Habib branches Free of Cost as compared to IBFT on which charges are applicable.

- How do I pay using Raast?

You can send payments to a registered Raast ID or an IBAN for those banks currently active on the Raast network & similarly receive funds on your registered Raast ID or IBAN via AL Habib Branches, AL Habib Netbanking/Mobile Application

- Can RAAST be used to make international transactions?

No, RAAST is currently activated for only local transfers within Pakistan.

- Should I receive an SMS / Email once a transaction is complete?

Yes, successful transactions will be notified via SMS/email by your bank.

- What is the limit for Raast Transfers?

Raast P2P per day Transaction Limits in PKR Channel Transaction Limits OTC Any BAHL Account No Limit Any other Bank Account No Limit Net Banking/Mobile Banking Aggregate limit for both channels within BAHL & Other Banks PKR 2,000,000 Raast P2M per day Transaction Limits in PKR Net Banking/Mobile Banking Aggregate limit for both channels within BAHL & other Banks PKR 500,000